Vendors must therefore register for a sales tax license and collect and remit tax. Click on the links to access additional information about sales tax requirements for temporary vendors in a given state.Īll sales at retail, except those defined by law, are subject to sales tax. Read on for a state-by-state sales tax guide for craft fair vendors. Even the terms used to describe craft fair vendors and sales can differ in different states: one state department of revenue website may use the term “temporary vendor,” while another uses “occasional sales.” No wonder it’s often challenging to find pertinent information. There are states with exceptions for some vendors/sales, and, of course, states with no general sales tax (but other rules for temporary vendors).

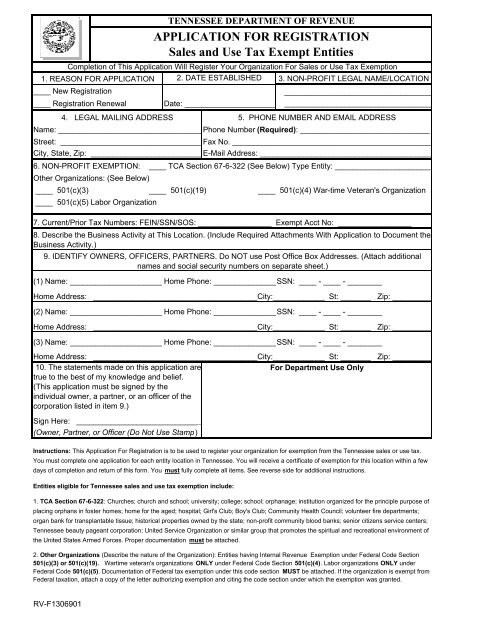

#Tn salesx tax law registration

Most states require sellers - even temporary or transient vendors from another state - to register with the state and collect and remit tax on sales of taxable goods and services.īut sales tax laws and policies vary from state to state: some treat temporary vendors like any other seller, while some have a distinct registration process for them. If you sell at craft fairs, flea markets, and similar events, you should probably be collecting sales tax.

0 kommentar(er)

0 kommentar(er)